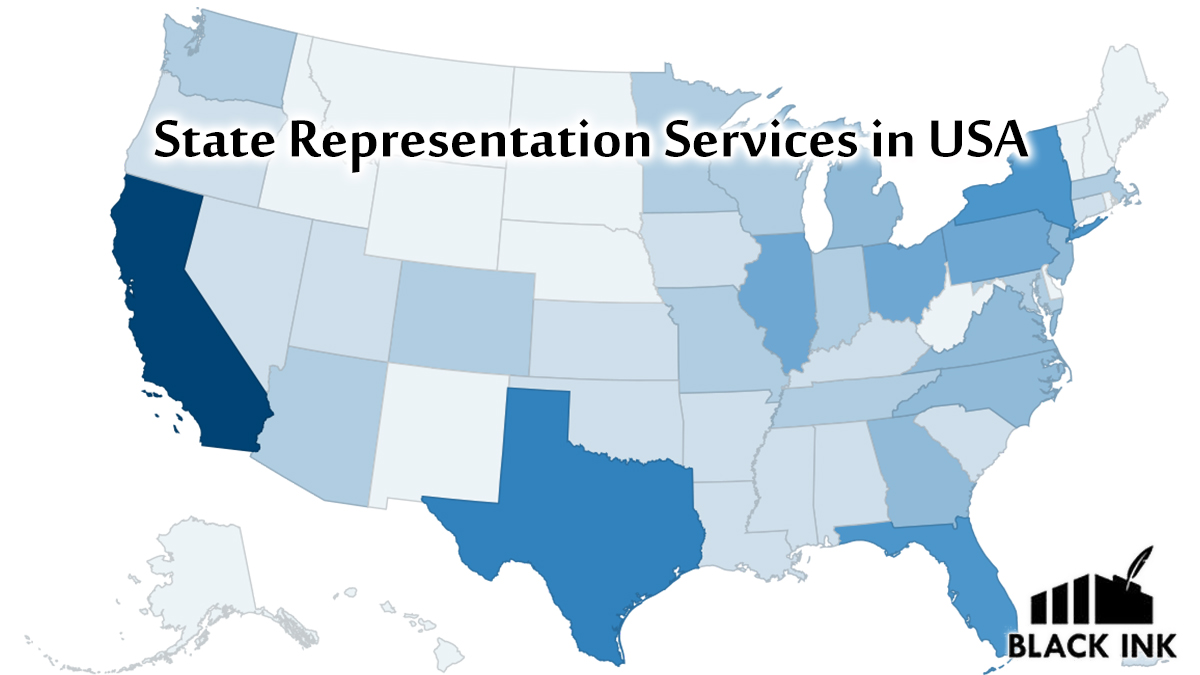

State Representation Services in USA

CharlestonTaxcity offers up-to-date state audit representation services throughout South Carolina and in various other states, including New York, New Jersey, Texas, Arkansas, Massachusetts, Vermont, and Connecticut. Each state in the United States has its own taxation authority or agency that regulates tax laws and regulations. Typically, these agencies are referred to as the “Department of Taxation” or “Department of Revenue.”

It is important to understand that the authorities and legislation governing taxation can vary significantly from state to state. In most states, these Departments regulate state-level taxes but do not manage local taxes. However, some states have combined taxation and revenue departments that oversee both state and local taxes.

CharlestonTaxcity is committed to providing exceptional accounting and taxation services across the United States. We aim to be your trusted state representation agent, offering comprehensive state representation services tailored to your business and personal needs.

Our State Representation Service

CharlestonTaxcity offers exceptional state representation services across the United States, delivering dedicated support for a variety of state audit needs, including:

- By Mail State Representation Services

- Random State Representation Services

- In-Office State Representation Services

- Field State Representation Services

If you require assistance with state tax preparation and filing, look no further than CharlestonTaxcity. We provide reliable state representation services tailored to meet your tax needs. It’s essential to remember that state tax returns must be filed separately with the respective state tax authorities; they should not be combined with federal tax filings.

Our team of seasoned experts is well-versed in the intricacies of state taxation laws and regulations across the nation. You can trust us to navigate the complexities of your state’s department of revenue or taxation on your behalf. With CharlestonTaxcity, you can rest assured that your state taxes will be filed and paid accurately and on time, allowing you to focus on what matters most to you. Book an appointment today and experience peace of mind with our dedicated service!

Our State Representation Service

The main types of state taxes in the United States include sales and use taxes, property taxes, and state income taxes. If you need assistance with state tax preparation or planning, we offer reliable guidance to help minimize your state taxes legally. We ensure protection for our clients during tax assessments and collections, safeguarding their rights and privacy. We are knowledgeable in both graduated and flat rate income tax filing methods. Contact us today to ensure compliance with your state revenue agencies.

State Taxes vs. Federal Taxes in the USA

In the United States, a multi-tiered income tax system allows federal, state, and sometimes local governments to collect taxes from individuals and businesses. While both federal and state taxes are based on taxable income, they differ significantly in tax rates, taxable income definitions, and criteria for taxation. Additionally, tax credits and deductions vary greatly between state and federal taxes. We offer accurate state representation services tailored to the needs of our clients in their specific states.

The federal tax system allows taxpayers to claim either a standard deduction or itemized deductions, but not both. The Tax Cuts and Jobs Act (TCJA) significantly increased standard deductions in 2018. As of 2019, the standard deduction amounts are $12,200 for single taxpayers, $18,350 for head of household filers, and $24,400 for married couples filing jointly.

Many states also offer partial or full exemptions on retirement income, which is fully taxable at the federal level. This is why retirement planning and advisory services are essential in the U.S. to ensure your retirement income is not heavily taxed. Additionally, tax treatment of bond interest differs: state taxes exempt interest on U.S. savings bonds, while federal taxes do not.

There are also major differences in tax credits between state and federal taxes, which necessitates distinct state representation services. For example, New York offers a tax credit worth 20% of premiums paid for long-term care insurance, while federal laws do not provide such a credit. However, federal tax credits do cover areas like retirement savings, educational expenses, and dependent care expenses. Moreover, the International Rescue Committee (IRC) provides an earned income tax credit, and 29 states, plus the District of Columbia, also offer their versions of this credit. Personal tax filing in the U.S. has notable differences between state and federal requirements.

State withholding tax also differs from federal withholding tax. While both operate similarly, states have their own version of Form W-4. Local and state governments can impose withholding on wage income, each with their own tax rates. Both state and federal income taxes may be withheld, but you cannot withhold both at the same time. It’s worth noting that seven states—Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming—do not impose an income tax. Tennessee and New Hampshire tax interest and dividend income but do not have withholding for wages.

If you find yourself confused by the complexities of state taxation in the U.S., feel free to request a free consultation with our representatives about our state representation services. We also offer an additional three months of free service from our portfolio, tailored to your needs, along with state representation in the U.S.

State Audit Representation Services in USA

If you receive a state audit notice in the U.S. from your state’s department of revenue or taxation, stay calm. CharlestonTaxcity offers expert audit representation services nationwide. Our dedicated team specializes in state representation and understands the complexities of state audits.

We recommend clients not represent themselves, regardless of the audit’s perceived simplicity. Our precise tax filing and preparation services ensure timely submissions and reduce the likelihood of audits.

As tax laws continuously change, we provide exceptional taxpayer representation to protect clients from potential penalties and fines. Our services include state audit representation for both individuals and businesses.

We encourage you to stay informed by following our News Section, where you will find ongoing updates and important developments in the areas of business, accounting, and taxation across the United States.

Get a Free Quote Today For All of Our Services

Fill out the form below and we will send you a free analysis of your current state and what would be the cost of managing either a separate accounting and bookkeeping services or a complete solution across South Carolina, USA. Do get in touch and we will be happy to consult you with our bookkeeping services in SC, South Carolina, USA.

GET FREE QUOTE FOR ALL OF OUR SERVICES

CharlestonTaxcity will send you a free analysis of your current state and what would be the cost of managing either a separate accounting and bookkeeping services or a complete solution across South Carolina, USA. Do get in touch and we will be happy to consult you with our bookkeeping services in SC, South Carolina, USA.